The Main Principles Of Fortitude Financial Group

The Main Principles Of Fortitude Financial Group

Blog Article

The Only Guide for Fortitude Financial Group

Table of ContentsFortitude Financial Group Fundamentals ExplainedRumored Buzz on Fortitude Financial GroupHow Fortitude Financial Group can Save You Time, Stress, and Money.How Fortitude Financial Group can Save You Time, Stress, and Money.The 7-Minute Rule for Fortitude Financial Group

Note that several advisors will not manage your possessions unless you meet their minimal needs. When selecting a monetary consultant, find out if the specific complies with the fiduciary or suitability standard.If you're looking for monetary suggestions but can not afford an economic advisor, you might think about employing a digital financial investment expert called a robo-advisor. The wide area of robos spans systems with access to economic consultants and investment administration. Encourage and Improvement are 2 such examples. If you fit with an all-digital platform, Wealthfront is an additional robo-advisor option.

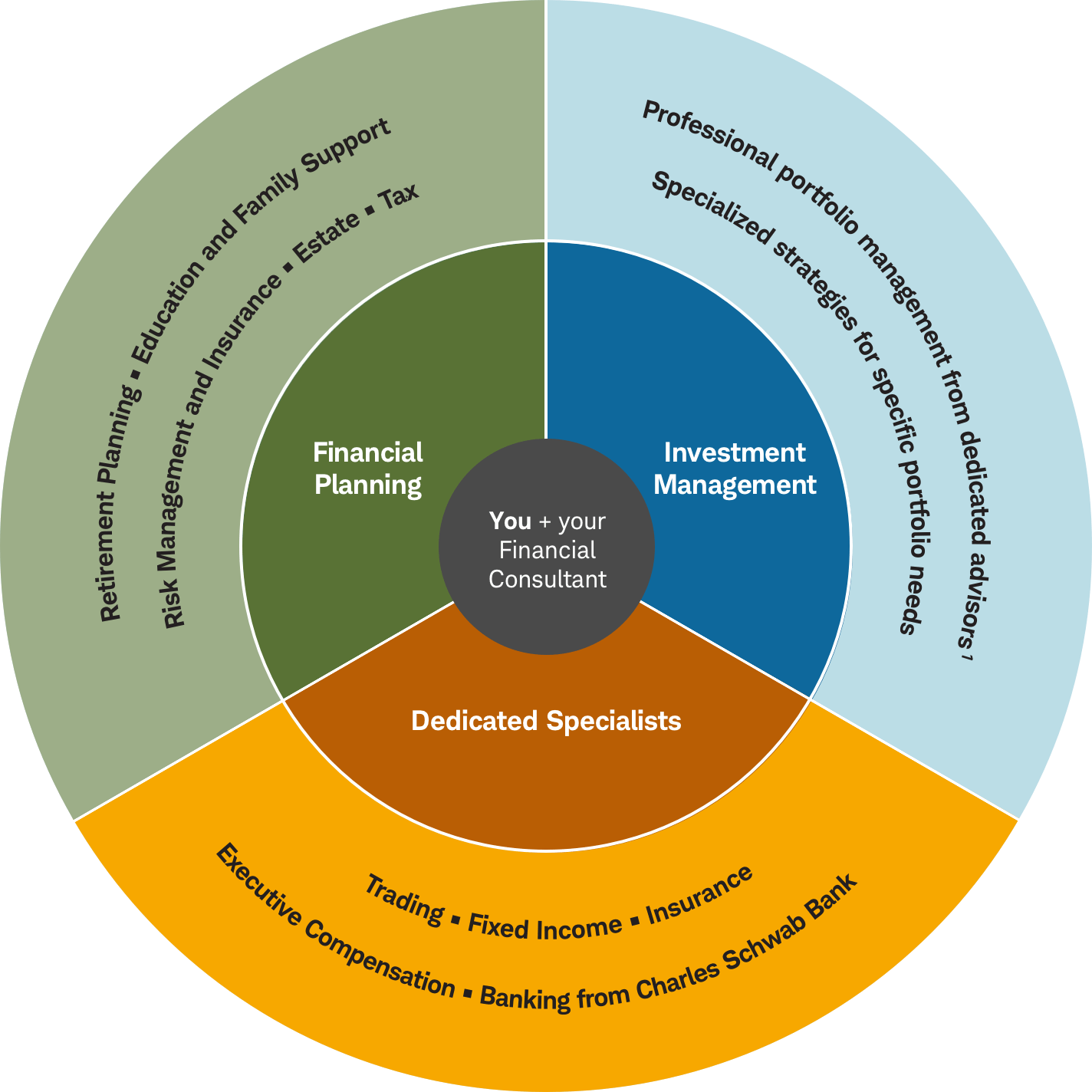

Financial consultants may run their own firm or they may be part of a bigger office or financial institution. Regardless, a consultant can help you with everything from developing a monetary plan to spending your cash.

The Basic Principles Of Fortitude Financial Group

Check that their qualifications and abilities match the solutions you want out of your expert. Do you want to learn more about economic experts?, that covers principles surrounding precision, dependability, editorial freedom, experience and objectivity.

Many individuals have some psychological link to their cash or the things they get with it. This emotional connection can be a key reason we may make bad financial decisions. An expert financial consultant takes the emotion out of the formula by providing unbiased guidance based upon understanding and training.

As you experience life, there are monetary decisions you will make that could be made much more quickly with the assistance of a professional. Whether you are trying to decrease your debt load or want to begin intending for some long-term goals, you could take advantage of the services of an economic expert.

Fortitude Financial Group Things To Know Before You Get This

The basics of financial investment management include buying and marketing monetary possessions and other investments, yet it is more. Managing your financial investments includes recognizing your brief- and long-lasting goals and using that details to make thoughtful investing decisions. A monetary consultant can provide the data necessary to help you expand your financial investment portfolio to match your wanted degree of threat and fulfill your monetary goals.

Budgeting offers you a guide to just how much money you can spend and just how much you ought to save monthly. Complying with a spending plan will assist you reach your brief- and lasting financial goals. An economic consultant can aid you outline the action steps to take to establish up and keep a budget plan that benefits you.

Occasionally a clinical bill or home repair can all of a sudden contribute to your financial debt load. A specialist financial obligation monitoring plan assists you repay that financial obligation in one of the most economically useful method possible. A financial advisor can help you analyze your debt, prioritize a financial debt settlement strategy, give options for financial debt restructuring, and describe a holistic plan to much better take care of financial debt and satisfy your future economic goals.

What Does Fortitude Financial Group Mean?

Individual cash money circulation analysis can inform you when you can manage to buy a new vehicle or just how much money you can include in your savings monthly without running short for necessary expenditures (Financial Services in St. Petersburg, FL). A monetary consultant can aid you plainly see where you invest your cash and afterwards apply that understanding to assist you recognize your financial well-being and how to boost it

Threat monitoring services identify prospective threats to your home, your car, and your family, and they assist you place the right insurance policy plans in location to alleviate those dangers. An economic consultant can assist you establish a strategy to safeguard your earning power and reduce losses when unforeseen things take place.

Fortitude Financial Group Fundamentals Explained

Lowering your tax obligations leaves more money to contribute to your financial investments. Investment Planners in St. Petersburg, Florida. A financial advisor can help you make use of charitable providing and investment approaches to decrease the quantity you have to pay in taxes, and they can reveal you exactly how to withdraw your cash in retirement in a method that additionally lessens your tax obligation concern

Also if you didn't begin early, university preparation can assist you put your kid through college without dealing with all of a sudden big expenses. A monetary expert can lead you in recognizing the most effective ways to conserve check out this site for future university costs and just how to fund possible voids, explain just how to reduce out-of-pocket university costs, and encourage you on qualification for economic aid and grants.

Report this page